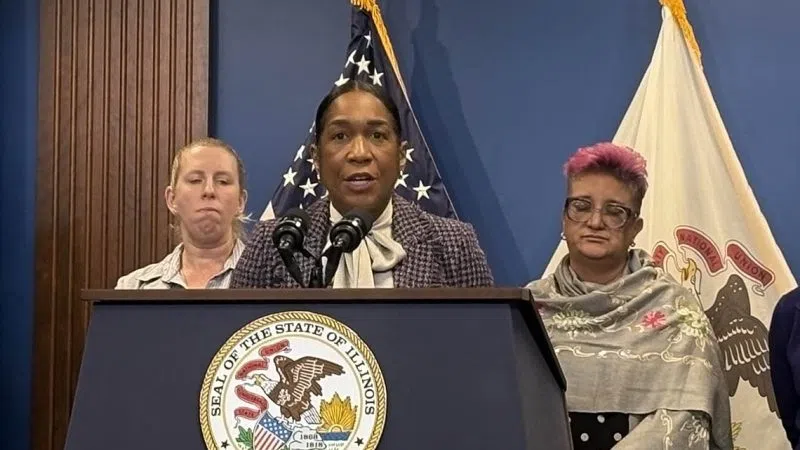

Pat Devaney, secretary-treasurer of the Illinois AFL-CIO, testifies before a House committee Wednesday, Oct. 29, 2025, in favor of a bill to overhaul the state’s Tier 2 pension system. (Capitol News Illinois photo by Peter Hancock)

Article Summary

- A House panel passed a Tier 2 pension reform Wednesday, but only after promising to hold further action until the spring.

- Advocates say the reform is needed because the benefits under Tier 2 could be found insufficient as compared to Social Security, which would cost the state billions of dollars over decades.

- While it moved forward in committee, Gov. JB Pritzker told reporters there’s “a lot more work” that needs to be done before the proposal becomes something he would sign.

This summary was written by the reporters and editors who worked on this story.

SPRINGFIELD – A House panel on Wednesday advanced a bill aimed at reforming a state pension plan known as the “Tier 2” system, but only with the understanding that negotiations will continue and no final action will be taken until next spring at the earliest.

“We’ve been at this for a couple of years,” Pat Devaney, secretary-treasurer of the Illinois AFL-CIO, said during an interview after the committee vote. “Over 50% of our members statewide that are in the pension plans are Tier 2. They are realizing what an insufficient deal that is in terms of retirement security and demanding that changes are made.”

Devaney is also a leader of a coalition of labor unions that have been pushing for changes to the Tier 2 system called We Are One Illinois.

Lawmakers passed the Tier 2 system in 2010, during Democratic Gov. Pat Quinn’s administration, as a way of reducing the state’s pension costs. It established a new set of rules governing pensions that apply to public employees — including those working for the state, local governments and school districts — who were hired on or after Jan. 1, 2011.

Since its inception, however, critics have warned that instead of reducing future costs, Tier 2 could end up costing the state billions of dollars in penalties, because its benefits are so meager that it likely violates a federal rule known as the Safe Harbor requirement. That rule requires state and local governments that do not participate in Social Security to provide some other retirement benefit that meets minimum federal standards.

“If the state fails Safe Harbor, then we would have to enroll everybody into Social Security. So that would more than double what we’re paying right now,” said Rep. Stephanie Kifowit, D-Oswego, a lead sponsor of the bill. “Almost half our budget would have to go to pensions and Social Security. … So the cost of doing nothing is extreme.”

Proposed Tier 2 pension changes

The proposed changes to the Tier 2 pension system are contained in a House amendment to Senate Bill 1937. Some of the key elements involve lowering the minimum retirement age for people in the Tier 2 plan, raising the maximum salary on which a person’s pension benefits are calculated, and changing the way future cost-of-living adjustments are calculated.

For example, Tier 2 employees currently must work until age 67 and have 10 years of service to qualify for full benefits. The new proposal would provide options for people to retire at 65 if they have 20 years of service, or age 62 if they have 35 years or more of service.

The proposal would also provide a more generous automatic cost-of-living adjustment, change the way a worker’s final average salary is calculated, and raise the salary cap that limits a person’s maximum retirement benefit to make it equal to the Social Security wage base.

In May, the legislative Commission on Government Forecasting and Accountability released an analysis of the major elements contained in the bill that estimated those benefit enhancements would add about $5 billion through 2045, not adjusted for inflation. That assumes the state stays on track to raise the pension funds’ funded ratio up to 90% during that time.

To bring the funds up to a 100% funded ratio by 2049, the total cost with the enhanced Tier 2 benefits would be $13.9 billion, not including inflation.

To pay that cost, the bill proposes to use a portion of the money the state is currently spending to repay the $10 billion in pension obligation bonds it issued in 2003. Those bonds are set to be retired in 2030. When that happens, the bill proposes redirecting 40% of the money that otherwise would have been spent on bond payments to instead pay for the enhanced benefits.

That, however, would only cover the state’s increased cost. Critics argue local governments, including cities and counties, would also face increased pension costs that could force them to raise local property taxes.

“It would all but ensure a stealth property tax being imposed on the localities across the state and it would open the door to credit rating downgrades at a time when the state has been rebuilding its credit from near junk status,” Joe Ferguson, president of the Chicago-based Civic Federation, told the House committee Wednesday.

At a news conference Thursday, Gov. JB Pritzker said he also has concerns about the bill and that he believes it needs “a lot more work” before it’s ready for legislative action.

“Remember, I’m not going to sign anything that is credit negative for the state,” he said. “We are making a lot of progress in the state. Many of you know we just got our 10th credit upgrade. It’s more credit upgrades than any state has received any time in the last 25 years, and we’ve received them in the last five years. We need to keep on with that progress. And so, whatever we end up doing needs to make sure it isn’t taking us backward.”

Capitol News Illinois is a nonprofit, nonpartisan news service that distributes state government coverage to hundreds of news outlets statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation.